Routing

What is dynamic routing?

Dynamic routing is a payment orchestration technique that enhances users' payment experience while automating the process of increasing approval rates. It involves directing payment transactions to the most suitable payment service provider or acquiring bank based on various factors such as card type, transaction amount, currency, and payment origin. You can also use the Smart Routing feature, which uses artificial intelligence to identify the optimal conversion rate and allocate transactions to the most suitable provider.

Routing ConfigurationIf you're using our Embedded or Semi-lite checkout integrations, you can configure the routing of your enabled payment methods after setting the conditions for when each method should be displayed. However, if you're using the Lite version, all available payment methods will be immediately accessible, allowing you to start configuring how each payment is processed.

Editing Published RoutesYou can configure and edit any aspect of a published route, including monitors and other settings. Published routes remain fully editable.

Why use dynamic routing?

Yuno's user-friendly dashboard offers a graphical interface to configure business rules for payments. Yuno's dynamic routing feature allows you to create personalized payment flows by defining validation and processing services according to your specific requirements. As a result, you can prioritize services that align with your needs, such as those with lower fees or higher approval rates.

By leveraging dynamic routing, you will enjoy several advantages:

Optimization

You can optimize your payment processing strategy in response to market changes, regulatory demands, or other factors. By quickly adjusting routing rules, you can seamlessly switch between PSPs or services, ensuring you will always use the best options for processing transactions.

Reduced costs

Dynamic routing allows you to significantly reduce payment processing fees. By routing transactions through the most cost-effective PSP or service, you can take advantage of lower fees or better exchange rates offered by different providers for specific currencies or transaction types.

Fraud mitigation

You can direct high-risk transactions to specialized fraud prevention providers or PSPs with advanced fraud detection capabilities, minimizing your exposure to fraudulent activities.

Increased processing speed

Dynamic routing ensures efficient and speedy transaction processing. Directing transactions to the most suitable PSP or service based on transaction volume, processing capacity, or response times can enhance the overall customer experience while reducing the likelihood of transaction failures or delays.

Configuring the dynamic routing

- First, access your Yuno dashboard and go to Routing. The Routing section separates the payment methods by published and Not published. In the Not published tab, you will find the payment methods connected to your account that don’t have a published route.

- Choose a payment method and click on Set up. A panel will then appear, click on Create new route to start configuring routes.

- Name the route you will build and hit Save.

- Use the Add new condition button to define the condition that will trigger the payment processing route.

- Select and define one or more condition types to narrow the route usage. The conditions available vary depending on the selected payment method. Check a condition to see intuitive options for configuring each.

- Add connections to the condition created. Click the arrow next to your condition and then Add step. You will see a list of available connections including fraud solutions, processors, and acquirers, select one and click Select. If you select more than one connection, you will have to click Next and either determine the percentage of payments going through each, or select Smart Routing to handle the allocation automatically based on your preference.

- For each new connection, you can define paths for each possible case (Succeeded, Declined, and Error). New steps can be connected to each scenario to build a complete routing that meets your demands.

- After adding all steps of the payment process route, you can publish it using the Publish button, making it available for the respective payment method.

Smart routing

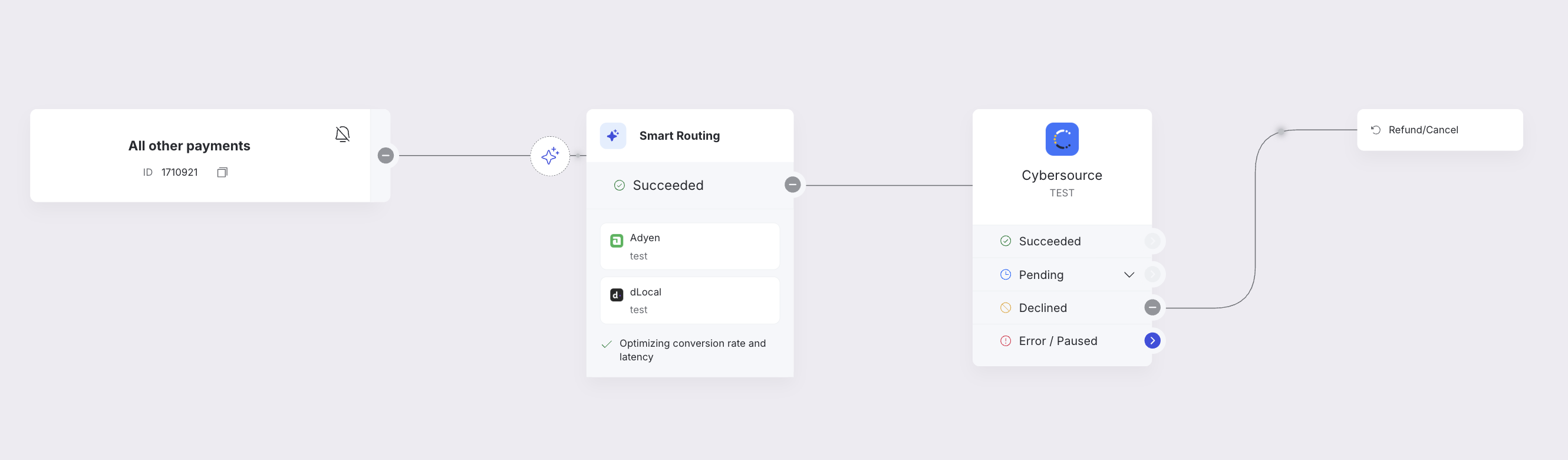

Smart Routing is a solution designed to intelligently optimize payment performance according to the variable you choose to optimize as a merchant. To activate Smart Routing, select two or more connections when setting conditions, click Next, and turn on the Smart Routing toggle.

Smart Routing can optimize your payments in two ways:

- Conversion rate and latency: Make intelligent decisions to optimize processing time while also achieving the highest conversion rate.

- Conversion rate and costs: Make smart decisions to optimize costs while also achieving the highest conversion rate. Input the costs associated with each provider through the Connections section. Smart Routing uses the costs you set up on the connection page to optimize your costs.

You only need to specify which providers you want to work with and which variable you want to optimize, and Smart Routing will route each payment through the optimal path.

Smart routing can be applied automatically, optimizing payment distribution for you. Alternatively, manual control lets you define the exact percentage of transactions to route through each connection.

Post-authorization after Smart Routing

You can add a post-authorization provider after a Smart Routing step. This lets you run additional actions, such as risk reviews or settlements/captures, after approval. Add a new step and choose your desired provider (for example, Cybersource).

Antifraud & Authentication

You can configure antifraud and authentication flows as part of your routing configuration. These flows help enhance security and compliance for your payment processing.

How to configure antifraud and authentication flows

When building or editing a route in the Routing section:

- After adding a connection or step to your route, click on the step to configure it.

- In the step configuration panel, you'll find options for Antifraud & Authentication flows.

- Select the flow type you want to configure:

- 3DS: Enable 3D Secure authentication to add an extra layer of security for card payments. This requires cardholders to complete additional authentication during the payment process.

- Preauth: Set up pre-authorization flows to validate payment methods before completing the transaction. This allows you to verify that funds are available and the payment method is valid before finalizing the transaction.

- Postauth: Configure post-authorization flows to perform additional checks after a payment has been authorized. If a post-authorization check is declined, you can set up a cancel transaction action to automatically reverse the authorization.

- Configure any additional settings specific to the selected flow type.

- Save your changes to apply the configuration to your route.

Available flows

- 3DS: Configure 3D Secure authentication to add an extra layer of security for card payments. This flow requires cardholders to complete additional authentication steps during the payment process, helping reduce fraud and comply with Strong Customer Authentication (SCA) requirements.

- Preauth: Set up pre-authorization flows to validate payment methods before completing the transaction. This allows you to verify that funds are available and the payment method is valid before finalizing the transaction, reducing the risk of declined payments later in the process.

- Postauth: Configure post-authorization flows to perform additional security checks after a payment has been authorized. If a post-authorization check is declined, you can set up a cancel transaction action to automatically reverse the authorization, protecting your business from fraudulent transactions that pass initial authorization.

Automatic capture

You can configure automatic capture with a defined delay. This allows you to automatically capture authorized payments after a specified time period, streamlining your payment processing workflow.

Automatic Capture ConfigurationAutomatic capture with delay is configured via the Create Payment API using

delayed_capture_settingswhen creating a payment. This feature is not currently available in the Routing dashboard interface. For detailed information on configuring delayed capture, including delay format and settings, see the Cancel and Capture Flow documentation.

When using automatic capture:

- Set

capture: falsein your payment request - Configure

delayed_capture_settingswith adelayfield following ISO 8601 format (e.g., "P7D" for 7 days, "PT3H" for 3 hours) - Optionally set

simplified_mode: trueto enable automatic retry if capture fails

The automatic capture will process authorized payments after the specified delay period, reducing manual intervention and ensuring timely settlement of transactions.

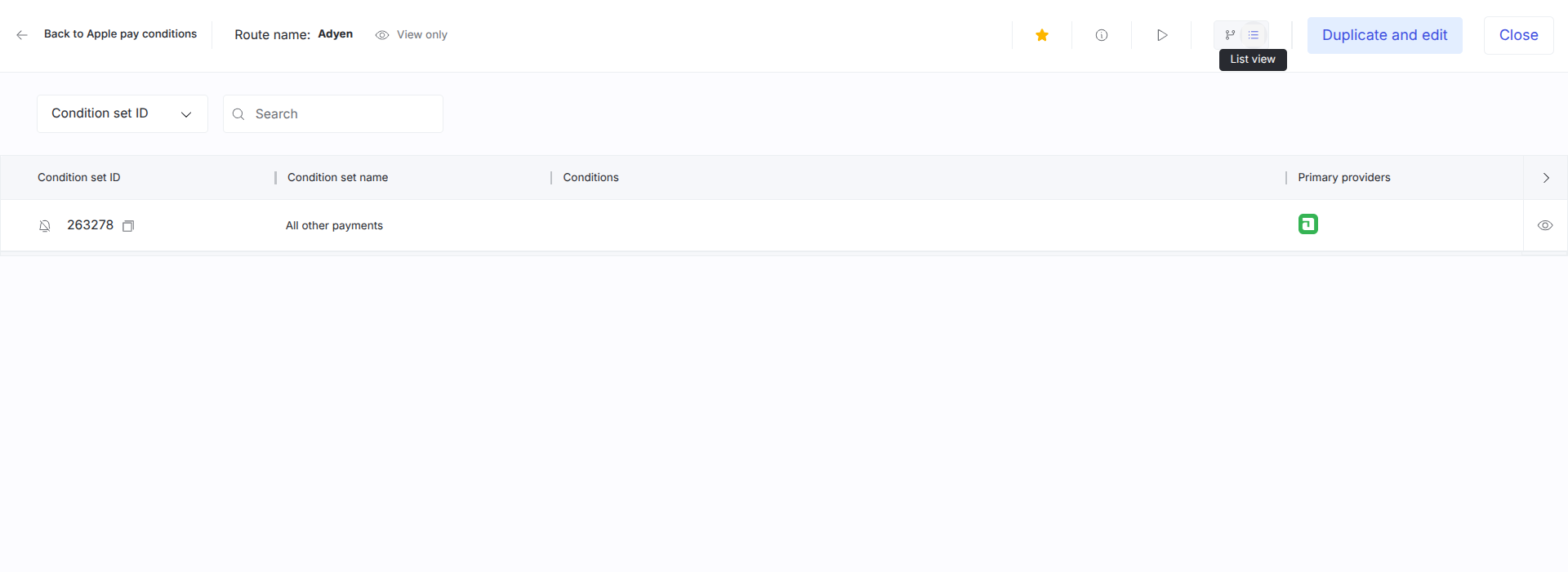

List view

When working with complex or lengthy routes, you can use the List view instead of the visual flow diagram. The List view provides a structured, table-based representation of your route configuration, making it easier to review and manage routes that have many condition sets or complex configurations.

To access List view, navigate to a route in the Routing section and click the List view button in the top navigation bar. The List view displays your route configuration in a table format with columns for Condition set ID, Condition set name, Conditions, and Primary providers.

You can filter condition sets by ID, search for specific configurations, and click the eye icon on any row to view detailed information. This view is particularly useful when your route has many condition sets or when the visual diagram becomes difficult to navigate.

Updated about 1 month ago